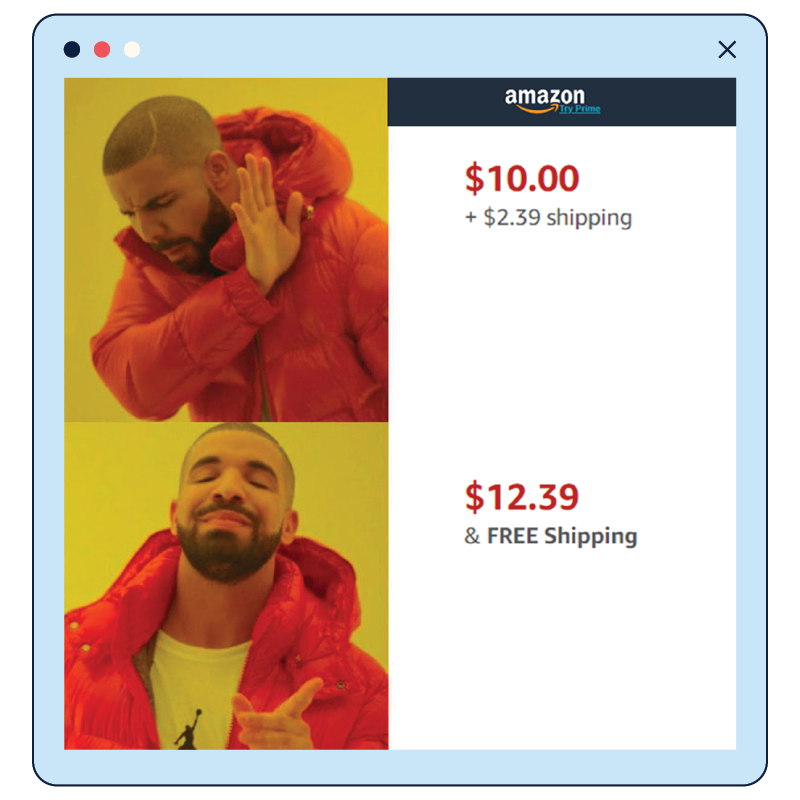

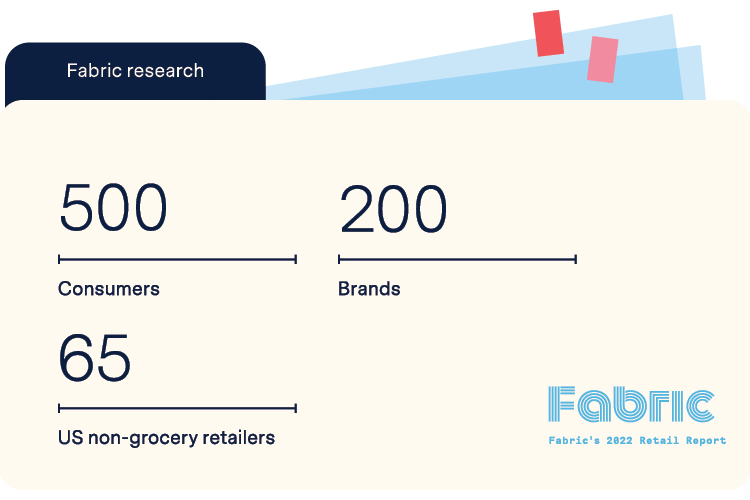

1. Free shipping is irrationally important to consumers

Free shipping is the #1 driver in motivating consumers to complete an online purchase. They would rather pay more overall to qualify for free shipping than pay separately for shipping.

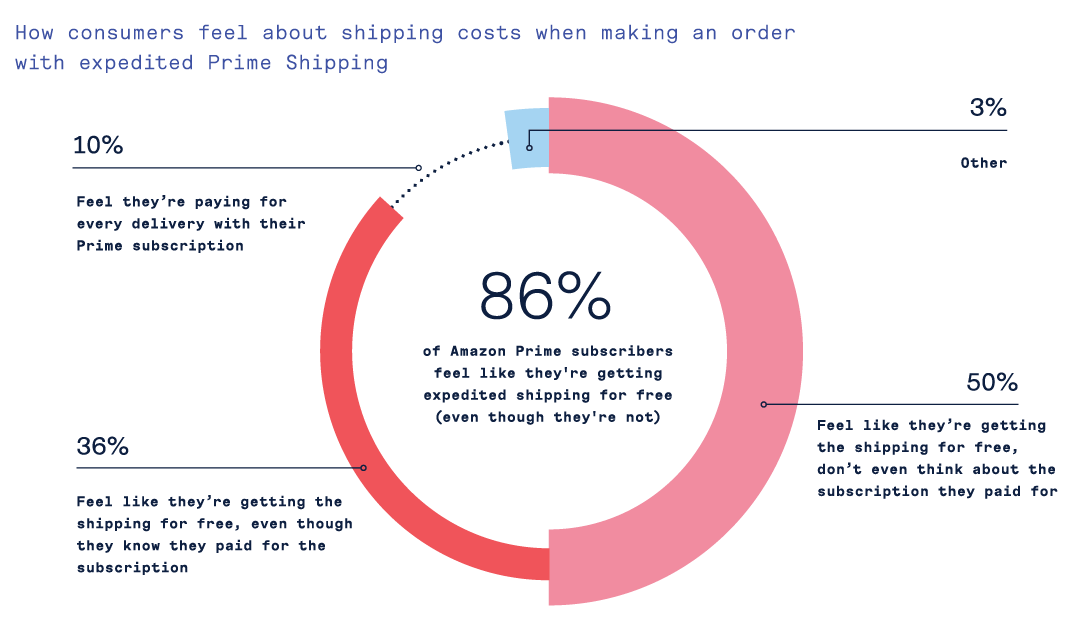

2. Amazon Prime has habituated consumers to fast, “free” shipping

Most American adults are Prime Members, meaning they spend $14.99 a month or $139 a year for same-day and next-day delivery. Notably, 86% of Amazon Prime subscribers we surveyed feel like they’re getting expedited shipping for free and don’t feel the impact of their subscriptions.

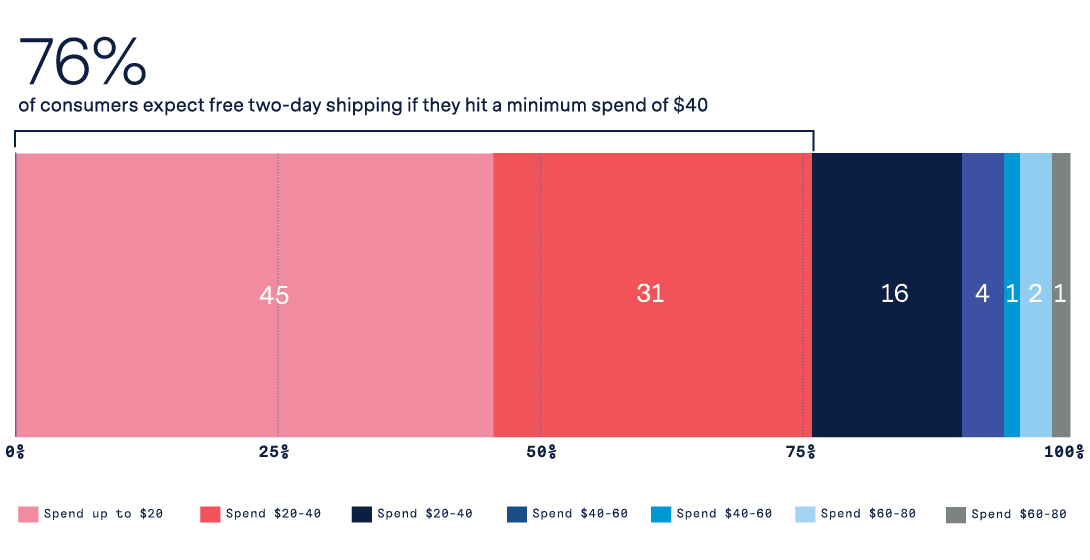

3. Free two-day shipping is already table stakes for consumers

76% of consumers expect free two-day shipping with a minimum purchase of only $40, and 8 out of the 10 biggest retailers in the US offer free two-day shipping. Among them, six require no minimum purchase, only two require a subscription, and the retailers run the gamut across industries, from prescriptions to power washers.

4. There’s already a sizeable appetite for free next-day and even free same-day shipping

61% of consumers expect free next-day shipping and 52% expect free same-day shipping with a minimum purchase of only $40. Retailers are stepping up to the plate; 4 out of the 10 biggest non-grocery retailers offer free next-day delivery and of these, 2 require no minimum purchase and only one requires a subscription.

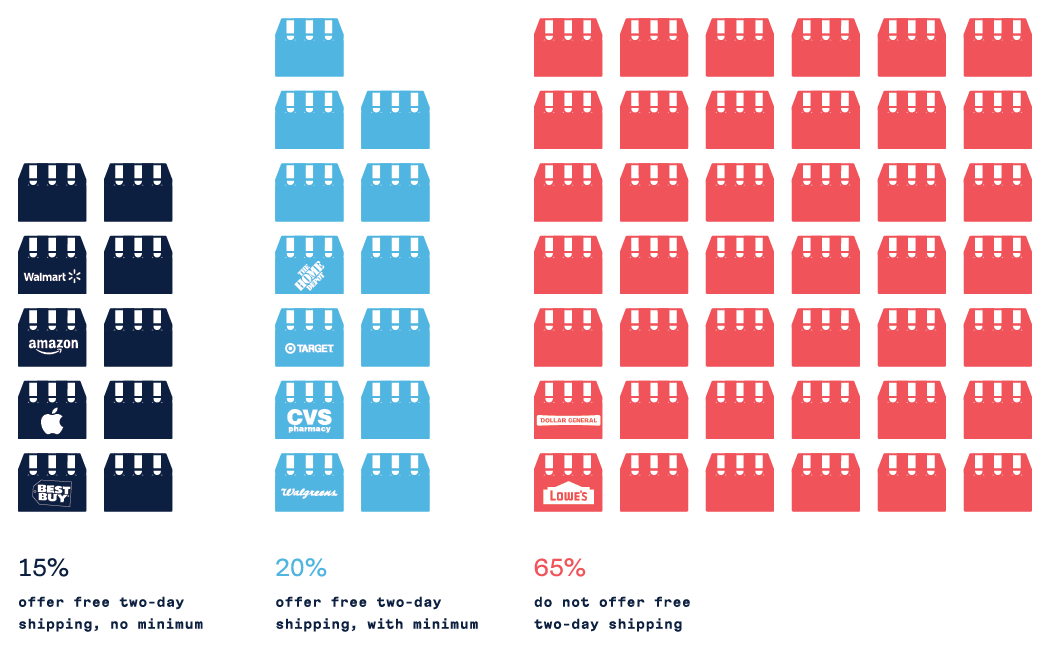

5. There is a significant power imbalance between the top 10 retailers and the rest of the market

While 80% of the 10 biggest retailers in the US offer free two-day shipping and most of them require no minimum purchase, only 26% of the remaining retailers on the list offer the service, and among them, most require a minimum purchase of at least $50.

6. Free shipping is difficult and expensive for brands to provide at any speed

The cost of standard shipping for a high-volume brand has increased by 71% in the last five years. 27% of the retailers in NRF’s top 100 list do not even offer standard shipping for free, much less at the speeds that consumers now demand.