The rise of e-commerce has put shipping carriers in a position of power, squeezing the retailers who rely on them

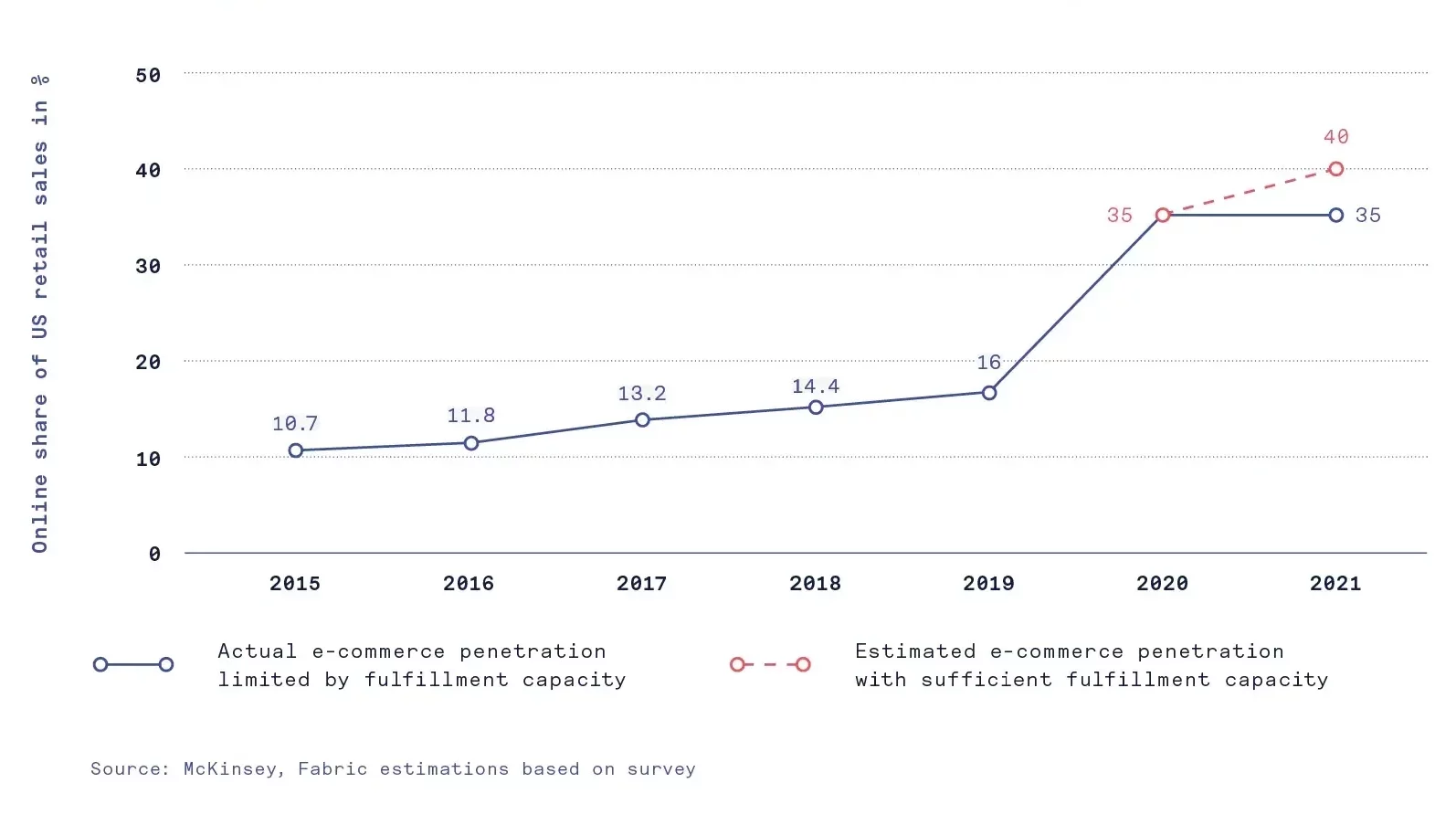

Even if retailers manage to successfully scale their fulfillment capacity to meet the surge in demand for online orders, they face daunting challenges in the next link of the supply chain: dispatching online orders and delivering them to consumers’ doorsteps. The meteoric rise of e-commerce has created a supply and demand imbalance that puts carriers in a position of power. UPS, FedEx, and USPS are said to control about 95% of last-mile deliveries of third-party parcels.

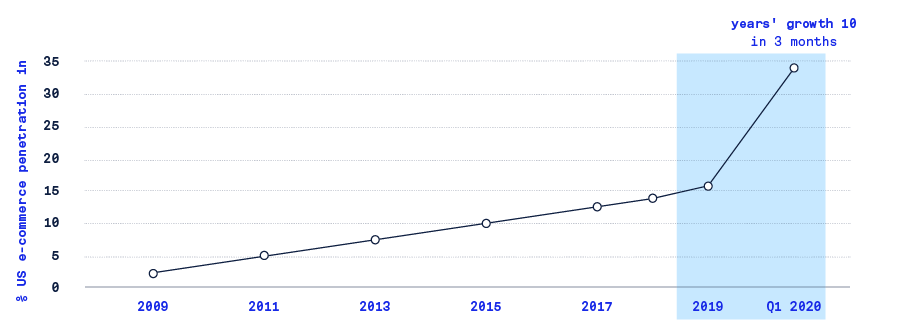

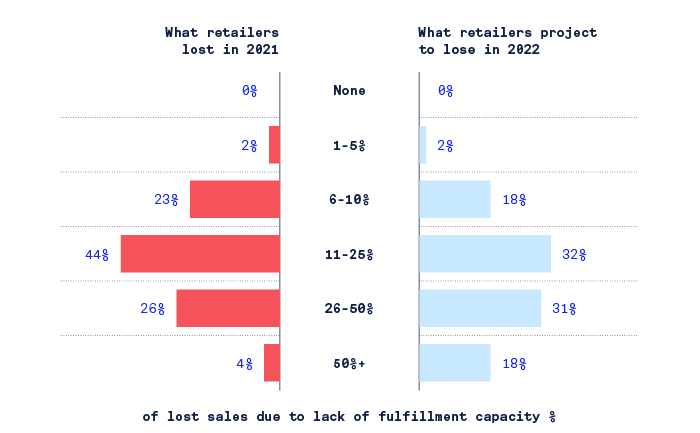

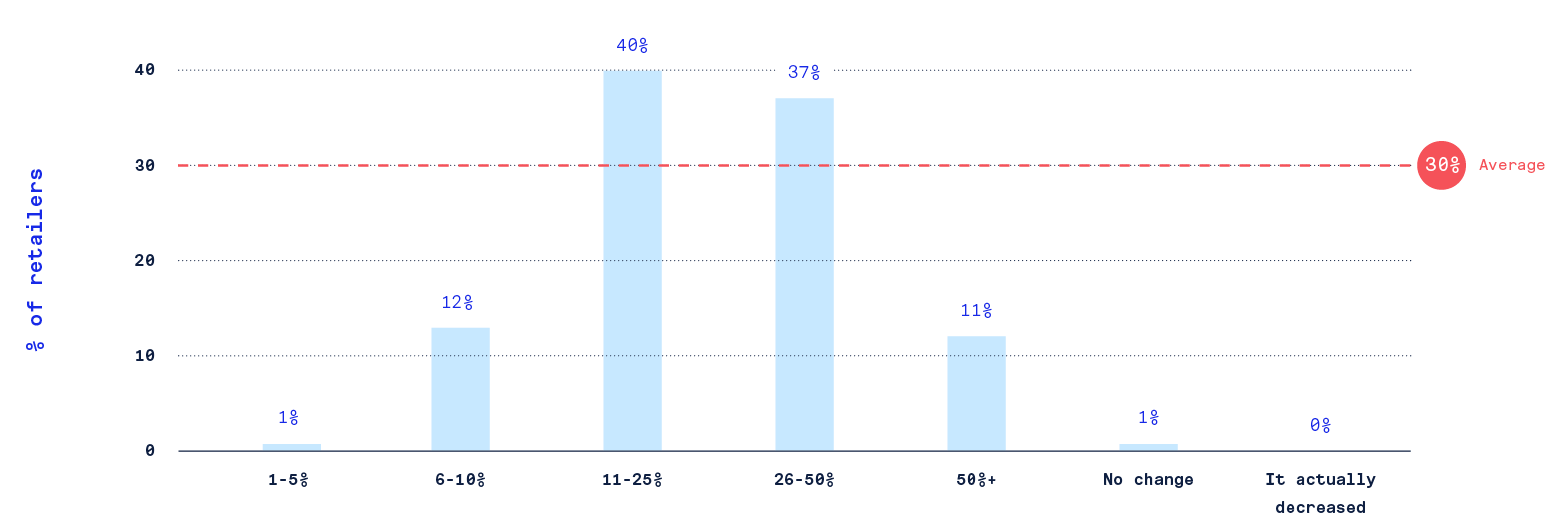

E-commerce order volume grew by an average of 30% in the last year, the vast majority of which was residential deliveries

The businesses we surveyed reported that their e-commerce order volume grew by an average of 30 percent last year, with 37 percent reporting that it grew by as much as 50 percent and another 11 percent reporting that it grew by more than 50 percent. The vast majority of these shipments have been residential deliveries, which are inefficient and barely profitable (if profitable at all) for shipping carriers.

Why shipping carriers prefer commercial (B2B) to residential (B2C) deliveries

1. Residential deliveries are inefficient, one-package stops

In residential deliveries, there is an average of 1.2 pieces per delivery,whereas in commercial deliveries, the pieces per delivery is about 2-3.

2. In residential deliveries, stops aren’t in close proximity to each other

Compared to business deliveries, where drop-offs are in dense urban centers usually in close proximity to each other, residential deliveries are widespread and far-flung. This makes B2C deliveries slow and expensive to execute.

3. Residential deliveries are besieged with problems and inaccuracies

Whereas most business deliveries require a signature and are largely headache-free, residential deliveries are prone to porch piracy and delivery to incorrect addresses.

As a result of this unanticipated volume, 3 million packages a day were delivered late prior to the 2021 peak season

Because of this unanticipated spike in residential delivery volume, delivery on-time performance (OTP) — considered to be a key indicator of shipping carrier capabilities — has suffered. Even prior to the holiday season, FedEx, UPS, and USPS hadn’t caught up to the Covid crush of demand and were struggling with their volume capabilities.

ShipMatrix estimates that in September 2021, 3 million parcels per day were being delivered late. These late deliveries are a costly and burdensome problem for shipping carriers, who have negotiated money-back guarantees with retailers in the event of such delays.

To manage this volume and protect service levels, shipping carriers have cut service to thousands of brands and retailers

The rise of residential deliveries and the stress it’s placing on shipping carriers has led to an existential reckoning of the retailer and shipping carrier relationship, with shipping carriers actively culling accounts that are burdensome and unprofitable.

One Friday in June 2021, FedEx Freight announced that effective the coming Monday, it was immediately cutting service to 1,400 customers, giving the retailers virtually no time to make alternative shipping arrangements. This move impacted not only smaller businesses, but also larger brands such as Lowe’s and Costco. The backlash was so swift and instantaneous that FedEx immediately reinstated partial service to a portion of the affected customer base.

This aggressive culling of accounts is the main reason that on-time performance metrics were strong during the 2021 holiday season, with FedEx hitting 97.4%, UPS 99%, and USPS 98.6% for the week of November 28th to December 4th. Framed differently, performance only improved because fewer residential deliveries were made.

In a 2021 Q3 earnings call, UPS CEO Carol Tome said, “We’re controlling the volume that comes into our network because we are laser-focused on revenue quality. We used to think that every package was the same; we don’t think that anymore. For some shippers, we’re no longer delivering their packages and that’s OK with us.”

That’s why retailers cite shipping carrier capacity limits as a top threat to their entire e-commerce business

We asked businesses what the biggest threats to their e-commerce business are, and shipping carrier capacity limits looms as a top threat, rivaling supply chain delays and eclipsing labor shortages and shipping and fulfillment costs.

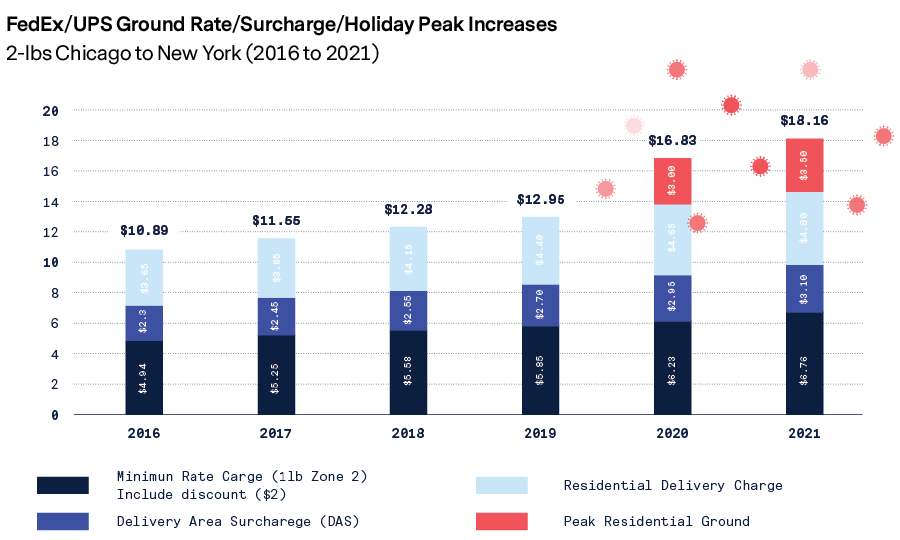

Carriers have also aggressively raised their residential delivery rates, with the price of delivering a package increasing by 71% in just 5 years

For high-volume brands and retailers, punitive surcharges incurred by FedEx and UPS have dramatically increased the cost of doing business. Due to peak residential surcharges imposed at the onset of the pandemic, shipping a 2-lb package via ground from Chicago to NYC skyrocketed from a little more than $10 in 2016 to more than $18 in 2021, based on our estimates.

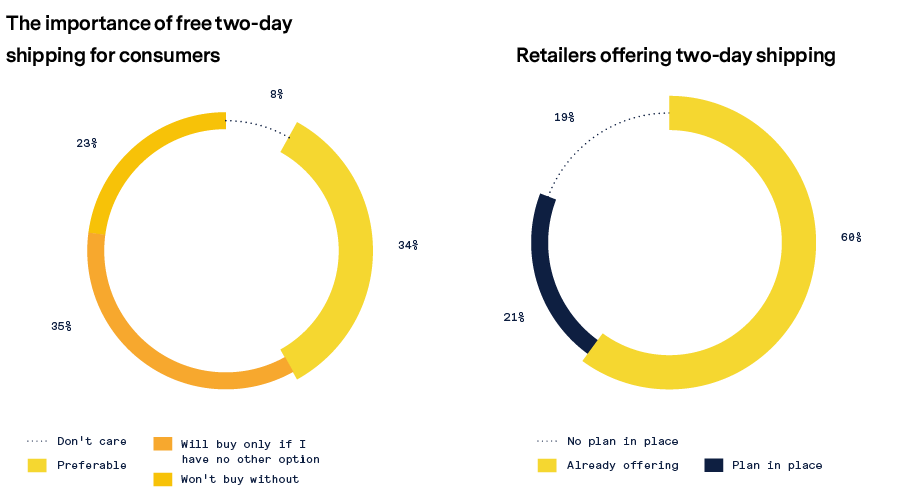

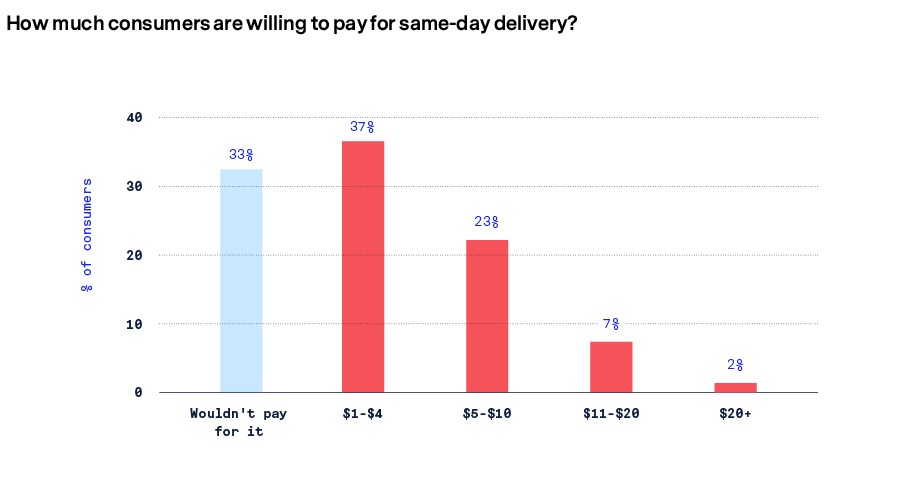

That’s an increase of 71% in just five years, inviting the question: with free shipping now a given for most consumers, how long can merchants continue to eat these costs?

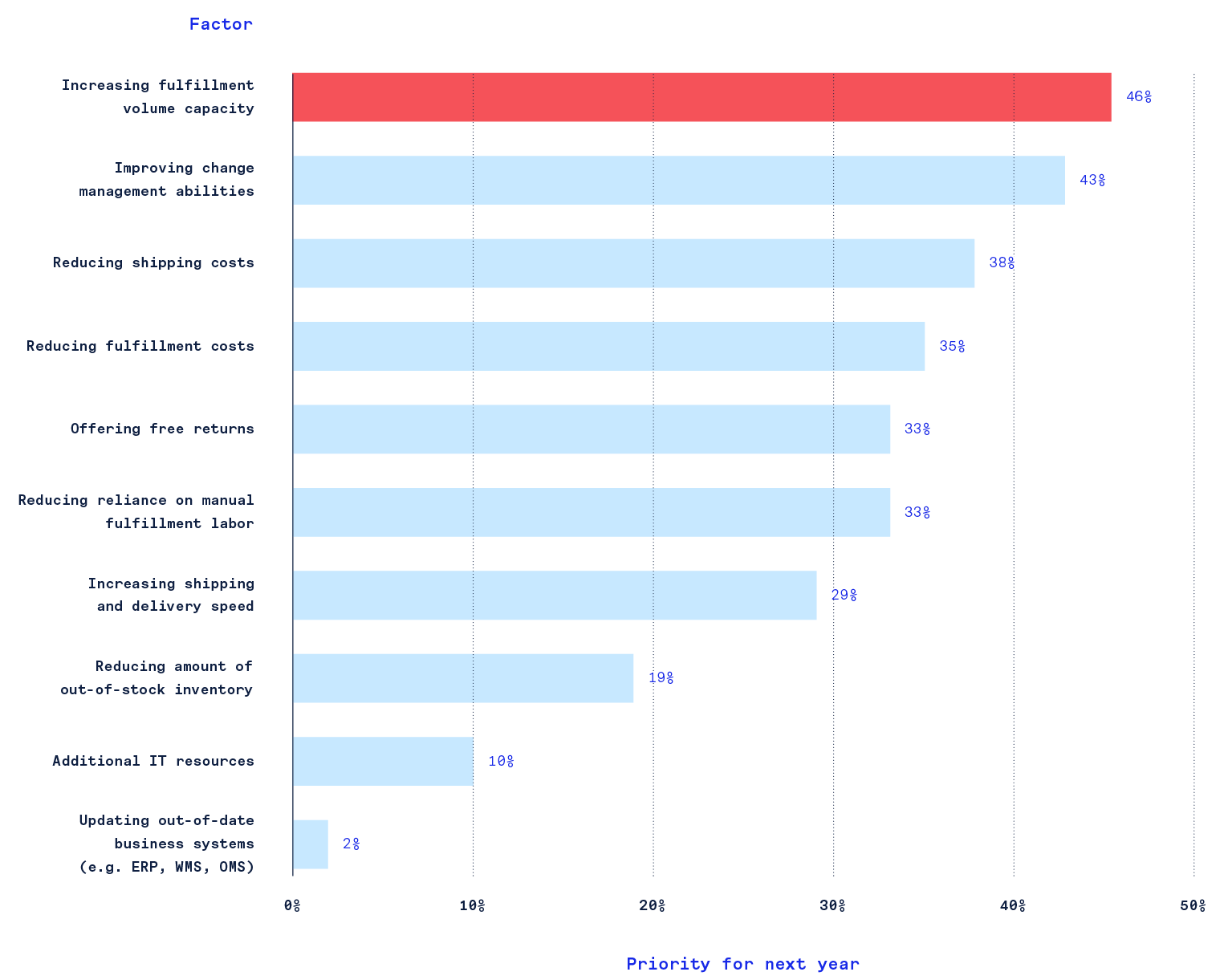

That’s why retailers cite reducing shipping costs as a top factor for success in this coming year

The rising residential delivery surcharges have become untenable amongst the retailers we surveyed. They report that reducing shipping costs is a top factor for success, rivaling increasing fulfillment volume capacity and overshadowing all other priorities, including reducing reliance on manual labor and reducing the amount of out-of-stock inventory.

With no obvious alternative to the large shipping carriers, retailers will need to take a fundamentally different approach to fulfillment to fix this power imbalance.