The best things in life are local. There’s a reason that “Persian” is synonymous with “rug.” The Swiss are renowned for their beautifully-crafted watches. And if it’s made outside of the Champagne region of France, it’s just sparkling wine.

Fulfillment is no different – the most future-proofed e-commerce strategy starts with local solutions.

E-commerce experienced 10-years worth of growth in just three months at the dawn of the pandemic. This exposed the cracks in retail’s foundation. A perfect storm of issues – labor shortages, shipping costs, shifting consumer expectations – worsened as online demand skyrocketed. Still struggling with insufficient fulfillment capacity, burdensome carrier-imposed constraints, and faster delivery windows, brands know the traditional fulfillment paradigm is failing them – but what’s the alternative?

If the last few years have taught us anything, it’s that it’s time for brands to throw the old playbook out the window and completely rethink their approach to supply chains.

Distributed micro-fulfillment centers strategically spread throughout multiple metropolitan areas eliminate barriers to scale while reducing delivery times and shipping costs. Augmenting your existing operations with local fulfillment centers doesn’t just alleviate some common retail bottlenecks – it has the potential to fix nearly every barrier to scale stymying e-commerce growth for modern brands.

Yes, really. Allow us to break down exactly how!

We’ve reached a tipping point with centralized fulfillment

From Ancient times up until the Industrial Revolution, supply chains were always regionally restricted as there was simply no infrastructure to support an alternative. Once railroads entered the equation in the 1900s, it became faster and cheaper to transport goods over long distances. After that, the entire supply chain shifted to a centralized model in just a few decades.

Henry Ford introduced mass production with the assembly line in the 1920s, and the increased efficiency changed trade laws and supply chains irreversibly. From there, it was one advancement after another – from the invention of shipping containers in the 1950s to the first real-time warehouse management system in 1975.

When Procter & Gamble began expanding throughout the ‘80s and ‘90s, they used a centralized production network to keep capital spending to a minimum. Back when oil was $10 a barrel and transportation vastly cheaper, this made sense. Centralized fulfillment has been the standard ever since.

Then, e-commerce entered the arena, and the Internet’s impact was on par with the Industrial Revolution.

E-commerce proved challenging for centralized fulfillment. Large-scale warehouses were originally designed to ship bulk orders to brick and mortar locations and were not well-equipped to ship small, individual packages directly to consumers. Plus, oil is no longer $10 a barrel – rising fuel costs are taking a serious toll on shipping prices. Combined with the increased consumer preference for fast delivery, it’s incredibly expensive to get items to end-customers who live hundreds of miles from warehouses and distribution centers.

In short, it’s getting more expensive and less efficient to rely solely on centralized fulfillment. Executives and CEOs are left wondering what to do. They’re aware there’s a supply chain crisis, but are stumbling in the dark for a solution. According to a 2022 survey by AlixPartners of over 3,000 chief executives, 58% are only focused on short-term supply chain solutions like paying more for materials and raising prices. While 77% feel such actions are insufficient, there isn’t an obvious alternative.

The solution? A return to the original supply. After all, they say what’s fashionable is cyclical. Local fulfillment is making its resurgence in a modern world – and for good reason!

Problem #1: Free two-day shipping is table stakes, but a challenge to execute

Earlier this year, we reported that 8 out of the 10 largest retailers in the US offer free two-day shipping, most of them without a minimum purchase! Given these retailers account for a sizable portion of total retail sales nationwide, we knew this would increase public appetite for fast, free shipping. However, we were shocked by just how much.

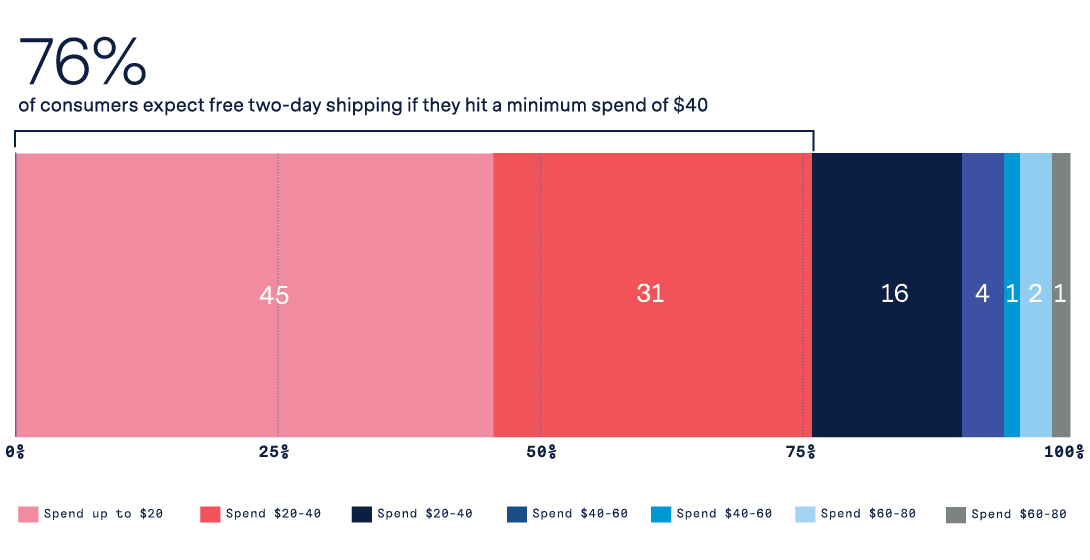

The numbers were startling. 76% of customers now expect free two-day shipping with a minimum purchase of only $40, and there’s already a growing appetite for one-day or same-day shipping. 61% of consumers expect free next-day shipping and 52% expect free same-day shipping with a minimum purchase of only $40.

We can’t emphasize this enough – free shipping isn’t an appreciated perk but a make-or-break aspect of the sales cycle. 1 in 4 shoppers we surveyed cite free two-day shipping as a “must-have.” Free two-day shipping is now table stakes, and free one- and same-day shipping are next.

While the Walmarts and Targets of the world can easily rise to this challenge, it’s far more difficult for other brands. In the best of times, free shipping is expensive with a centralized model, and we’re certainly not in the best of times. The carrier networks brands rely on – FedEx, USPS, and UPS – were never designed to accommodate 2022 consumer speed preferences, which is why Amazon utilizes its own shipping network to make these delivery windows. Supply chain problems and rising fuel costs are going to start driving up prices even more.

Solution #1: Local fulfillment makes fast shipping feasible

Executing two-day deliveries is a stretch as is. One-day delivery means factoring in an overnight flight, and same-day delivery? Forget about it. But when you move products closer to customers, things get a lot more financially feasible. Proximity is key to providing Amazonian delivery speeds at an affordable price.

Augmenting existing fulfillment operations with a local fulfillment strategy allows brands to dramatically reduce the distance between their customers and their inventory. Suddenly, two-day shipping isn’t such a Herculean task, and same-day shipping is often doable thanks to last-mile courier services (which we’ll touch on in more detail below) that are designed with fast shipping in mind. A network of MFCs strategically scattered across key markets unlocks your potential to keep up with consumer demand.

Problem #2: Rising shipping costs and an increased demand for fast delivery make the price of doing business untenable

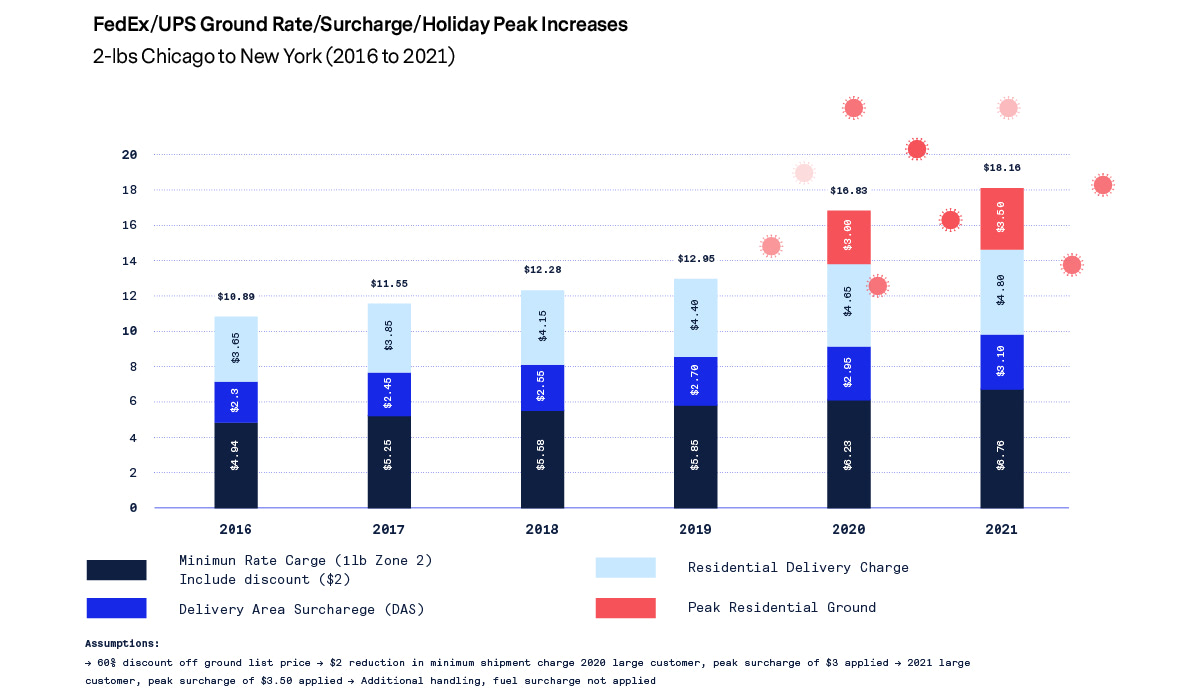

Even standard shipping costs are becoming unaffordable for brands. For a high-volume shipper, the cost of shipping a 2-lb package has increased by 71% in just 5 years. With fuel prices ticking upward, it’s only going to get worse. Brands we surveyed cited reducing shipping costs as a top factor for success, overshadowing nearly all over priorities – including reducing reliance on manual labor or reducing stockouts.

This uptick in shipping costs coincides with an increased demand for fast shipping. Free shipping is irrationally important to consumers – they’d rather pay more overall just to clear a free-delivery purchase minimum than pay extra for shipping. But how are retailers supposed to provide as much and remain profitable given rising costs?

27% of the retailers in NRF’s top 100 list currently do not even provide standard shipping for free, an indication that the cost of doing business has become completely untenable.

Solution #2: Local fulfillment actually makes on-demand delivery cheaper than standard shipping

Again, it’s all about proximity. There is a common misconception that on-demand orders are more expensive when processed locally, but they’re actually significantly cheaper, especially when you store your products in MFCs near where customers live. This can be a gamechanger for brands feeling the impact of rising shipping costs.

The distance between customers and products obviously reduces costs, but it also lessens your reliance on the Big Three shipping carriers – FedEx, UPS, and USPS – for last-mile delivery. As last-mile delivery accounts for about 53% of total shipping costs, the potential savings are huge.

With a local, distributed fulfillment strategy, you can often get close enough to end-customers and partner with last-mile courier services like DoorDash and UberEats or small, specialized delivery partners. This is often cheaper than paying for overnight or two-day delivery from a major carrier, meaning same-day delivery is potentially the more cost-effective option in certain scenarios. For example, for New York City customers, same-day delivery from a Brooklyn MFC via courier costs less than 3 to 5 day ground delivery from a distribution center in St. Louis.

Problem #3: 99% of brands have lost sales due to insufficient fulfillment capacity

There has never been an easy fix for the capacity problem given it’s caused by several factors.

First, there’s the manual labor issue. Labor shortages show no signs of slowing down, with 73% of warehouse operators reporting being unable to find enough labor to support demand. This has caused massive barriers to scale, warehouses sometimes unable to get up and running for over nine months due to labor shortages. Even in a hypothetical situation where a warehouse is fully-staffed, the on-demand economy means there are limits to manual labor. When processing massive quantities of orders, human error is inevitable. In fact, McKinsey recently called warehouse automation “imperative for sustainable growth.”

Second, there’s really no easy way to ramp up fulfillment capacity efficiently with a traditional centralized fulfillment model. Warehouses cost millions of dollars and take years to build, and most 3PLs are slow to integrate and patchwork at best. Many of them are already at capacity as well. The vacancy rate for warehouse space is shrinking, as low as 1.4% in key regions, and industrial rent rose by 11% in the fourth quarter of 2021.

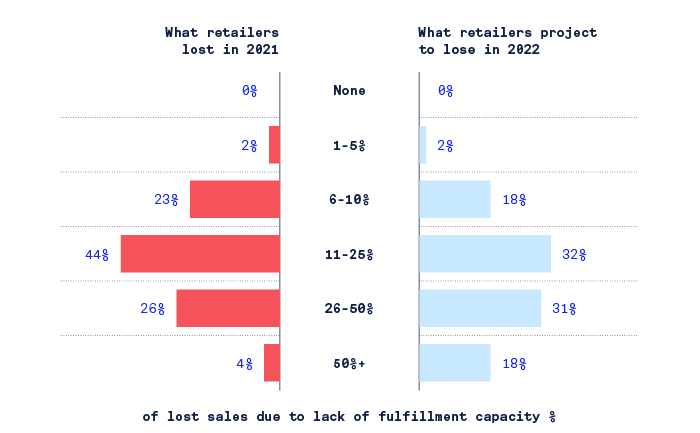

This has caused a massive problem for brands that it is impossible to overstate. Brands lost an average of 22% of sales last year due to insufficient fulfillment capacity. We surveyed 500 consumers and 200 retailers and brands about fulfillment capacity. 99% of brands have lost sales due to insufficient fulfillment capacity, 54% said they have inventory they’re not even advertising, and 45% have stopped running promotions on certain products.

Solution #3: Micro-fulfillment centers let you scale faster to enter target markets

Sometimes, less is more. Brands urgently need targeted solutions in the markets most important to them, but opening up massive warehouses is time-consuming, especially now.

Local micro-fulfillment means using smaller spaces, making MFCs faster to build and set up. This lets you tap into population-dense metropolitan areas much faster, attacking where there’s demand and where it will drive the bottom line.

In addition to being easier to set up, MFCs come with the added advantage of being heavily automated. This lessens your reliance on manual labor, helping you mitigate the impact of the labor shortage and create a more efficient operation overall. Fabric’s proprietary software-led robotic technology stack leverages the entire 3D cube of the real estate so you can densify storage and tuck warehouses into smaller spaces in key markets.

Problem #4: Cut-off dates and capacity limits from major carriers cost brands sales at pivotal times of the year

The Covid-19 pandemic threw a wrench in the already tenuous relationship between retailers and carriers. Big Three carriers were also struggling to keep up with demand and – at the peak season in 2020 – FedEx, UPS, and USPS failed to pick up an estimated 6 million packages a day. As a result, they made some tough calls. FedEx infamously cut off service to 1,400 customers in late 2021. Around the same time, many major carriers introduced stricter capacity limits and cut-off dates for the holiday season.

This is unfortunate as online holiday shopping was no passing trend. In 2021, Deloitte’s retail survey found 62% of holiday shoppers said they planned to shop online. What’s more interesting is that even last-minute shoppers are opting for online purchases. Klarna surveyed over 40,000 U.S. consumers and found that 79% left shopping to the last minute, and 55% of these last-minute shoppers planned to purchase gifts online. This means providing fast shipping during peak season is pivotal to customer satisfaction.

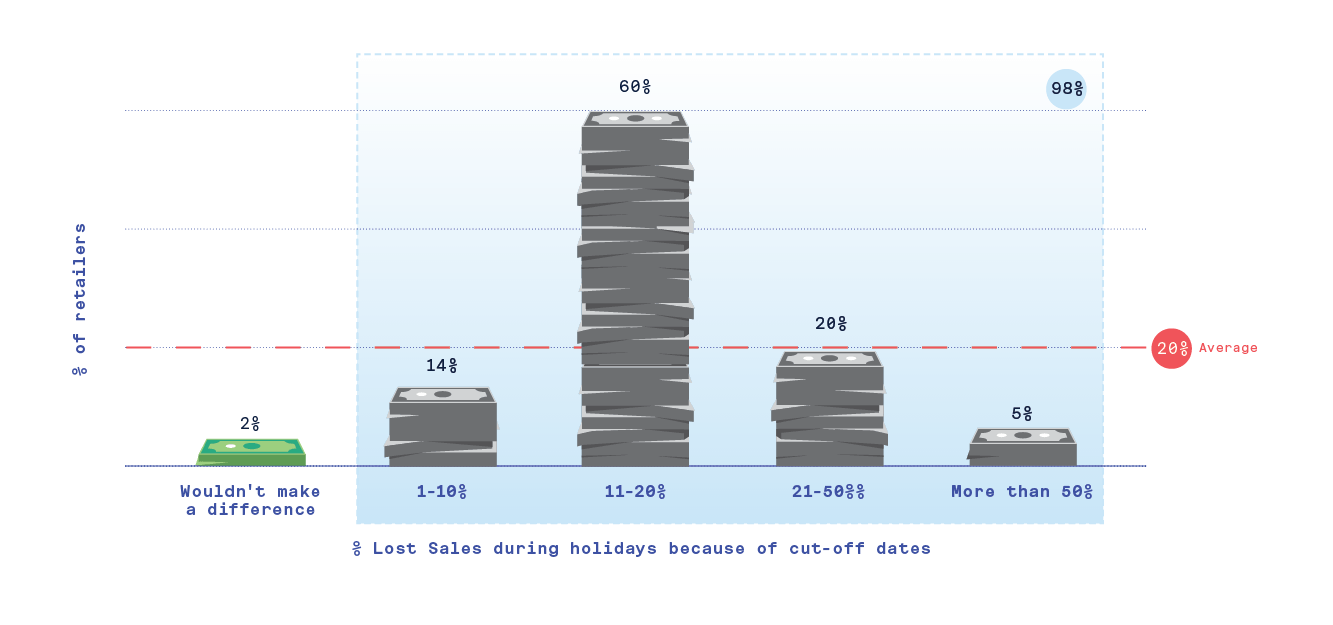

According to Google, one in three last-minute shoppers choose where to buy gifts based on how soon they can get them. If you’re largely dependent on major carriers like FedEx, USPS, and UPS, you stand to lose a lot of sales. When we surveyed brands about holiday sales, 98% said carrier-imposed cut-off dates lost them holiday sales and one third predicted losing 50% of sales next year due to capacity limits.

Solution #4: Local fulfillment lets you continue holiday delivery down to the wire

They say diversifying is the key to investing; the same is true of delivery. Brands will always need to work with major carriers, but – with local fulfillment – you unlock a wider variety of options for last-mile shipping. Courier services can help you get items to last-minute shoppers, incredibly important to your bottom line.

Holiday sales may account for up to one fifth of annual retail sales. Finding a workaround for capacity limits and cut-off dates is a huge advantage. If you can promise customers orders will arrive before Christmas day, you’ll stand apart from the competition during a crucial time of year.

The bottom line: Local fulfillment is the future of retail

This is not a situation where you can ride out the storm by doing more of the same. In a recent New York Times op-ed, economic journalist Peter S. Goodman says fixing the problems of the modern supply chain requires a multifaceted approach that includes an influx of truck drivers, a massive increase in warehouses, and more cargo ships. None of this is happening anytime soon – if it happens at all. In other words, the problems plaguing retail aren’t simply going away.

Even setting modern bottlenecks aside, the centralized model has always been risky. Placing your eggs in a single basket leaves you vulnerable in the event of unforeseen circumstances. A disruption at one warehouse could spur a domino effect, and there’s no sugar-coating it – our world is getting riskier. Just months before Covid, McKinsey predicted non-economic supply chain disruptions such as natural disasters and erratic weather patterns would become commonplace.

It’s time to combine your existing operations with a network of local MFCs. In fact, we’re already seeing forward-thinking brands doing just that. Target recently opened two micro-fulfillment sortation centers and plans to build five more in 2022. Starbucks is replenishing smaller cafes via smaller distribution centers placed in key markets.

There’s no getting around it. Brands must move their fulfillment operations closer to where customers live. This dramatically reduces shipping costs for you while providing customers the fast delivery that they want. Local fulfillment is better for you and your customers.