The rapid growth of online grocery offers exciting potential for retailers to reach new customers and deepen ties with existing ones.

Yet the quicker the channel grows, the more urgently grocers need to adapt their fulfillment methods.

As it stands now, most grocers haven’t found a financially sustainable model for online grocery operations. Instead of manually fulfilling online orders from within stores, grocers need to leverage in-house automation to make online grocery financially sustainable.

I Can’t Believe It’s Not Margins

Even before online grocery became significant, the grocery industry faced notoriously low margins. After taxes, net profit margins were only 1.2% in 2018, according to FMI.

Online grocery can make margins even worse due to the labor costs involved in fulfilling orders, and retailers ignore this reality at their own peril.

Specifically, for every delivery order fulfilled via manual, in-store picking, grocers lose an average of $10.50, according to a P&L from Jefferies (Jefferies.”Fulfilment Deep Dive: MFCs = Best Path to Profitability,” Oct. 23, 2019) that we explore in one of our recent grocery reports.

Curbside pickup isn’t quite as financially draining since there are no delivery labor costs, but grocers still lose $3 for each of these manually fulfilled orders. And even when the labor is outsourced to a third-party, grocers still lose $2.50 per order due to a combination of factors, such as lower average order size compared with online orders placed directly with grocers.

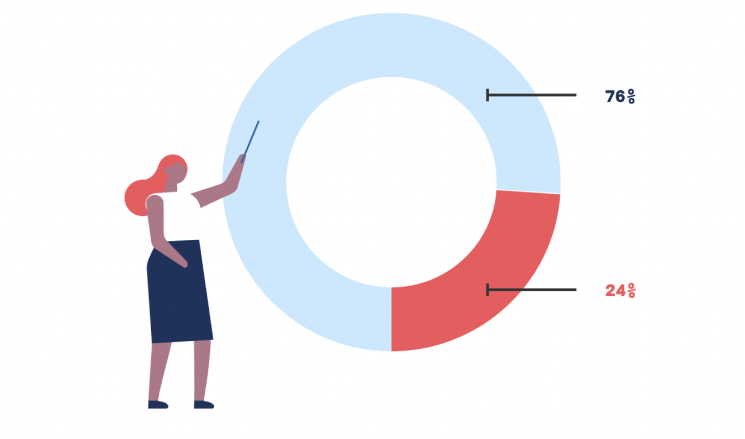

In the past, when online grocery only accounted for a few percentage points of total sales, grocers may have been able to eat these losses. Yet the Covid-19 pandemic has been a catalyst that’s already driven the online share above 12% toward the end of 2020. Additionally, our consumer survey found that even after the crisis ends, consumers still want to maintain around half of their online grocery purchasing.

That means that grocers can’t expect to carry on with a business model where profits shrink the more that online grocery grows.

Automation Is the Answer

To climb out of the profitability pit of online grocery, retailers need to turn to automation. As the Jefferies P&L finds, using a centralized, automated picking solution for delivery turns margins green, with retailers netting an average of $7.50 per order. Yet these centralized solutions pose their own challenges, such as with warehouses potentially being located far away from city centers, thereby making two-hour delivery windows difficult. Plus, they’re capital intensive to build out.

Instead, retailers can turn to micro-fulfillment centers, which allow grocers to use their own stores or other existing facilities near customers while still automating picking. Doing so yields the highest margins of any fulfillment method, either in-store or online. On average, retailers net $18 per delivery order and a whopping $24 per curbside pickup order when using automated micro-fulfillment centers.

A New Era in Grocery

The timeline for online grocery being a significant part of the industry has been rapidly condensed due to Covid-19, and grocers need to adapt soon, before the economics of manual online grocery fulfillment become overwhelming. Even if some grocers are getting a reprieve due to larger-than-average orders right now, you can’t outrun the math for too long.

Eventually, order size will regress closer to the mean, and grocers will need to make online fulfillment profitable. In doing so, they can grow their online presence, reaching new customers that might have shopped at competitors before but who want to switch to a grocer with a great online experience. Meanwhile, making online fulfillment profitable means grocers can continue to invest in creating great in-store experiences, as the majority of customers still want to shop in store, at least part of the time.