Retailers in the US are suffering more than ever from capacity limits and cut-off dates imposed by shipping carriers during the holiday season. These constraints aren’t new, of course; they’ve just never hurt like this.

Since the onset of the pandemic, retailers have come to rely on e-commerce as a key source of revenue as sales have rapidly shifted online. And as the subsequent demand for residential deliveries has increased, retailers have felt the impact of carrier constraints far more acutely.

We now have data to show just how much the constraints cost in terms of sales. Last year was, by all accounts, a “shipocalypse”: the first Christmas under Covid saw demand skyrocket and shipping carrier networks buckle under the sheer volume of packages. But our data suggests that retailers actually expect the damage to be worse this year.

In this article, we explore the data in detail and calculate the true cost these limits will have for retailers this holiday season.

Fulfillment capacity limits

What’s the problem?

There is always a limit on the number of orders a retailer can dispatch on any given day; after all, shipping carriers only have so much physical space and resources. But the holiday season represents a peak on top of a peak in terms of e-commerce, and the volume of packages retailers collectively want to dispatch far exceeds carriers’ capacity.

Last year was bad…

At the peak of the 2020 holiday season, the national delivery infrastructure failed to pick up an estimated 6 million packages per day. This led to severe delays, aggrieved customers, and a huge loss of sales.

Retailers estimate that they lost an average of 24% of sales last holiday season as a result of carrier-imposed capacity limits. 99% reported experiencing capacity limit-related losses and 37% claim that they lost up to half of their sales to the constraints.

…But this year will be worse

Retailers have not been able to mitigate their reliance on carriers throughout 2021, and most expect to see even greater losses this holiday season as a result of carrier-imposed capacity constraints. ShipMatrix currently forecasts demand to exceed capacity by around 4.7 million parcels a day; UPS estimates the number will be 5 million.

On average, brands expect to lose 25% of sales this year to capacity limits. And 1 in 3 predict these limits will cost them up to a whopping 50% of their holiday sales in 2021.

Cut-off dates

What’s the problem?

Shipping carriers’ reputations rest on timely, reliable fulfillment. When demand is at its peak, carriers can guarantee delivery by Christmas for only a certain number of packages that are dispatched by a certain deadline.

Cut-offs lead to losses

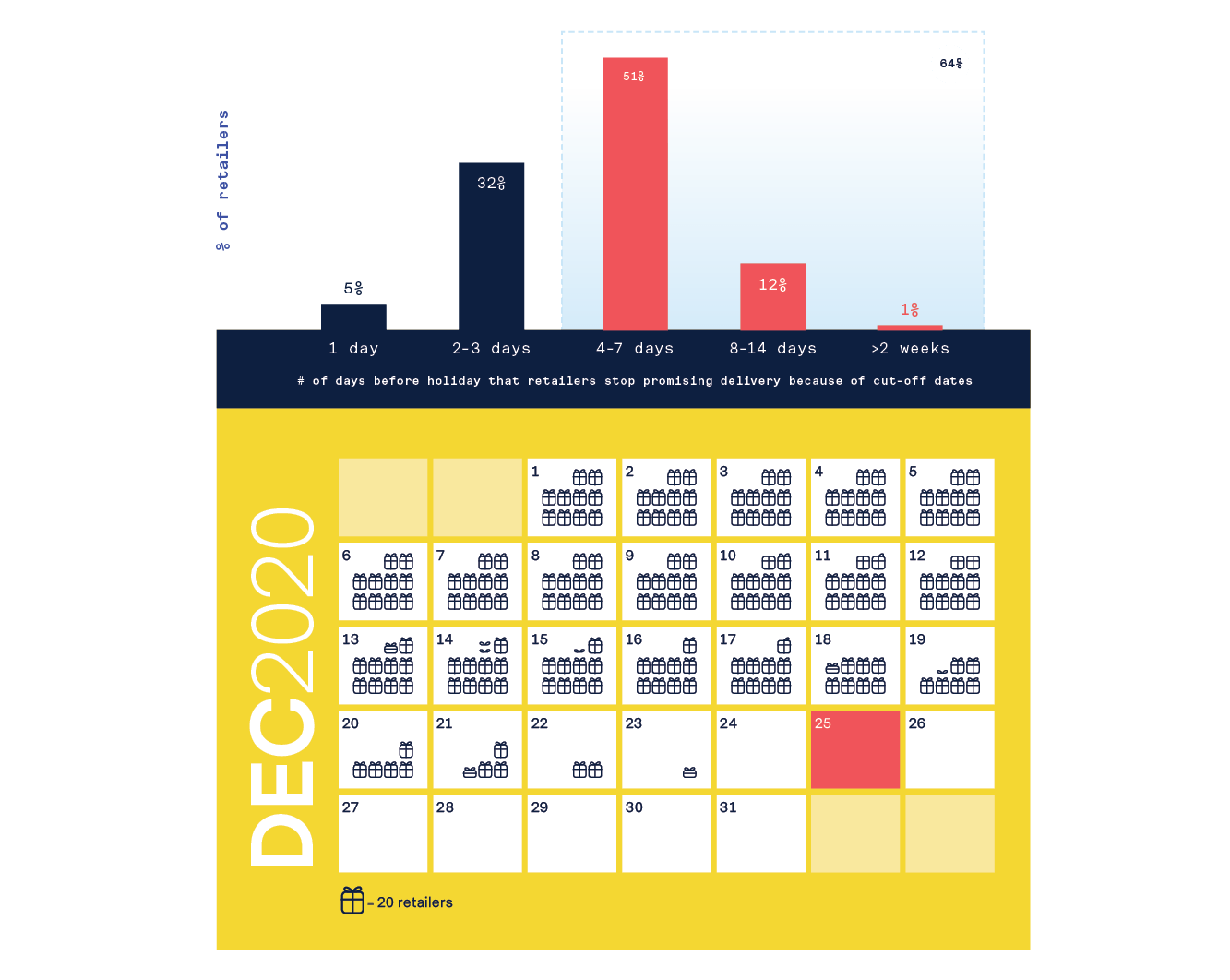

Carrier-imposed cut-off dates cause retailers to stop accepting orders in the run up to Christmas day. 51% of retailers say they have to stop promising delivery 4-7 days before Christmas, and a further 13% place that cut-off point two weeks before the big day.

This is particularly painful for retailers, because these final weeks are exactly when many consumers are most in need of fast delivery. Last year, online sales grew around 58% during the five days leading up to Christmas.

Who do these sales go to? The giants who’ve negotiated preferential treatment and have their own supply chain infrastructures in place. Amazon’s share of e-commerce sales tends to peak around one week before Christmas, exactly when carrier-imposed cut-off dates leave consumers with no other options.

So what are the total losses?

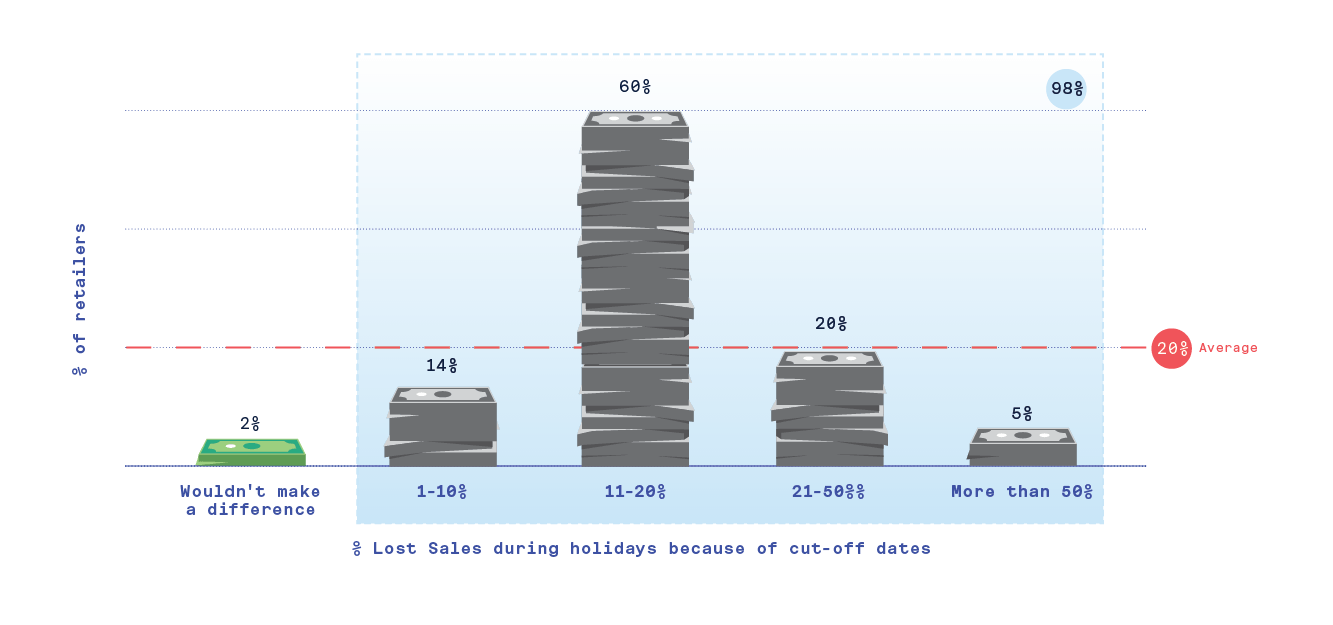

98% of retailers say carrier-imposed cut-off dates cause them to lose sales during the holidays, with the average loss being estimated at 20% of sales.

85% believe these constraints cost them more than 10% in lost sales, while 20% estimate the number to be up to 50%, and 5% claim it costs them more than half of their sales.

Cost of premium delivery services

What’s the problem?

After the heavy losses retailers experienced last year, many retailers have embraced stop-gap measures to ensure they capture more online sales in 2021. But in some cases, these solutions are exorbitantly expensive.

To overcome carrier-imposed cut-off dates, 59% of retailers plan to foot the bill of a premium delivery service at their own expense this year. This would be expensive at the best of times, but with extra holiday season surcharges, it will prove extremely costly – potentially to the point of being counterproductive.

Can retailers swallow the costs?

According to our calculations in collaboration with the Last Mile Experts, three-day delivery of a two-pound package from New York to Chicago would already cost between $14 and $19 through UPS or FedEx. But with the additional holiday surcharges, it will now set retailers back between $20 and $25.

Ultimately, the extra costs involved in using a premium service to overcome carrier-imposed cut-off dates may be worse than simply losing the sale – although that will be a decision for each individual retailer to make for itself.

There is another way for retailers

Despite the losses caused by their constraints, it’s important not to paint shipping carriers as villains here. They too are dealing with difficult margins, labor shortages, and spiraling costs.

Instead, we must see holiday season shipping constraints as emblematic of a larger structural problem. Such losses can only be the product of a broken system, with inventory centralized in only a handful of large fulfillment centers, and it is time for retailers to reimagine the way their supply chains are structured.

Retailers are increasingly realizing that what they need is a distributed fulfillment strategy. By housing inventory in more locations, they are able to shorten the distance between their goods and the end customer. This gives them access to regional carriers and last-mile courier services, meaning retailers can avoid the losses caused by overreliance on a small handful of shipping carriers.

95% of retailers say they are planning to embrace just such a distributed fulfillment strategy. 57% plan to fulfill from more locations in general, and 63% plan to fulfill from locations that give them access to last-mile courier services such as DoorDash. And in order to overcome carrier-imposed cut-off dates, 63% of retailers plan to fulfill from locations closer to customers to reduce shipping time.

By embracing these strategies, retailers will not only be able to mitigate against shipping carrier-imposed constraints, but they will also be able to truly future-proof their businesses, and maximize their profits for many more holiday seasons to come.