When the US went into its first lockdown in March of 2020, it spurred an explosion in online shopping. Almost two years later (yup), that explosion is still booming, leaving brands and retailers scrambling to adapt. Facing no shortage of challenges in the face of this increased demand, one of the trickiest things retailers have had to solve has also cost them the most: insufficient fulfillment capacity.

Why Fulfillment Is So Hard Right Now

The logistics of online order fulfillment have never been easy. But the dramatic rise in order volume — combined with pandemic-era challenges and the ever-rising bar of customers’ expectations — has made it more difficult than ever.

There are two primary hurdles to sufficient fulfillment capacity for brands and retailers:

Real estate

Traditional fulfillment methods require a lot of real estate — in fact, based on current demand trends, e-commerce retailers will need an additional one billion square feet of warehouse space by 2025. This pill becomes even harder to swallow when considering that the average industrial rent increased by a record 8.3% year-over-year in Q4 2020. In other words, simply finding enough space for inventory is breaking the bank.

Labor woes

The labor shortage is affecting companies across every industry and of every size, and it doesn’t show any signs of slowing: the U.S. labor force shrank in September, with 10 million open jobs and five million fewer people working than before the pandemic began. Brands and retailers are feeling the pain acutely, with a full third of retailers we surveyed saying that labor shortages were the top threat to their e-commerce business.

Even the behemoths of e-commerce have felt the hit, with Amazon’s CFO reporting that they’ve “been playing catchup” throughout the pandemic.

How Insufficient Fulfillment Capacity Is Impacting the Bottom Line

While consumer demand continues to boom, the twin challenges of real estate costs and labor shortages mean that retailers’ fulfillment capacity has remained static, and this discrepancy has cost them.

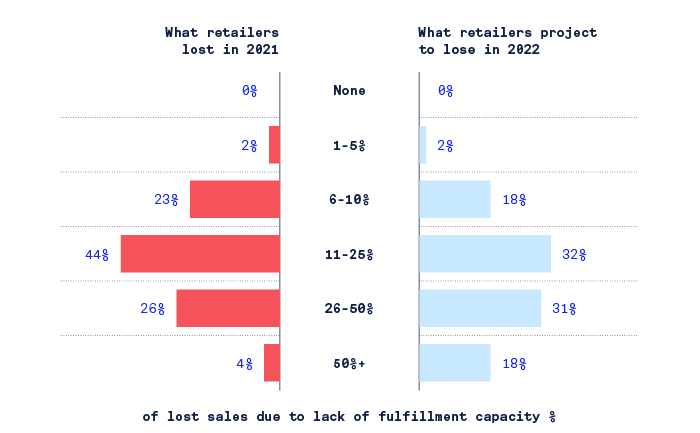

In fact, 99% of retailers we surveyed have lost sales due to lack of sufficient fulfillment capacity. They report that they lost an average of 22% of sales last year due to insufficient fulfillment capacity, and they expect that number to grow to 30% in the coming year if things don’t change.

One driver of these losses is a backlog of orders, with 50% of retailers from our survey saying that they have orders shipping late. This translates to a huge lost opportunity, not to mention unhappy customers (which hurts future sales).

Then there’s the fact that retailers’ are holding back on marketing efforts because they know they wouldn’t be able to keep up with the demand it would generate. More than half — 54% — of retailers said they have inventory in stock they’re not advertising, and 45% aren’t running promotions.

The retailers that can’t quickly increase their fulfillment capacity will inevitably lose market share to those who can.

Retailers’ 2022 New Year’s Resolution: Solving the Fulfillment Problem

Although retailers have a lot of headaches to manage during these unpredictable items, fulfillment capacity single-handedly eclipses all the others. In our survey, retailers cited increasing fulfillment volume capacity as their top priority in the new year, and the CFO of Amazon said that the company’s focus in the coming year is “squarely on adding capacity to meet the current high customer demand.”

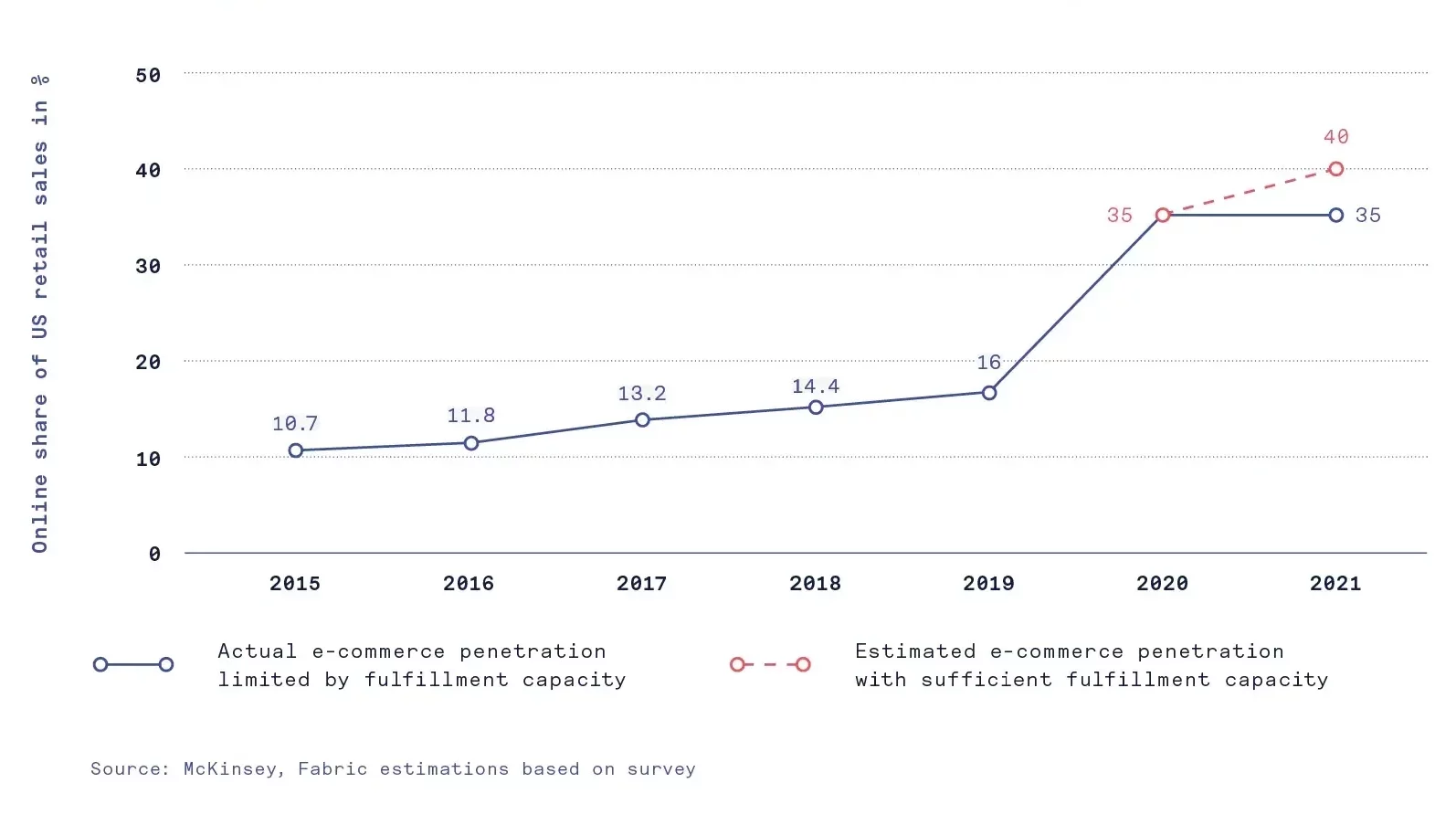

McKinsey estimates that online sales penetration has largely stabilized at about 30% above pre-pandemic levels, and we believe that the leveling off can be wholly attributed to an inability to fulfill orders. While some attribute this to people returning to their pre-Covid lifestyles, we think a much likelier reason is that retailers can’t keep up with this “shadow demand.” They’ve reached their fulfillment chokepoint, and it’s leaving money on the table.

We estimate that there’s a massive opportunity cost here. According to our calculations, online sales penetration would already be as high as 40% if retailers had the fulfillment capacity they needed to meet demand.

If retailers want to remain competitive in 2022 and beyond, they need to look at the fulfillment crisis head-on, make solving it a top priority, and start planning.

It’s time for brands and retailers to move away from the traditional, centralized fulfillment paradigm and towards a distributed strategy that is future-proof. Retailers don’t have time for long, slow initiatives like the typical three-year capital project of sourcing land and buying and installing automation. Retailers urgently need efficient targeted solutions in the markets most critical to them. A distributed fulfillment strategy can help them go live faster in these markets.

But it’s not the only piece of the puzzle; investing in automation will also be a key long-term strategy for retailers to reduce their reliance on manual labor, an enormous fulfillment constraint that shows no sign of improving.

To emerge from the fulfillment capacity crisis in fighting shape, brands and retailers need to look past what they’ve always done, and create a fulfillment infrastructure that meets the current market demands — or find strategic partners who can. Doing so not only solves the fulfillment struggles of today, but also future proofs retailers against the challenges tomorrow will bring.