Brands and retailers are overwhelmingly dependent on a vanishingly small number of shipping carriers, and the relationship between the two has grown increasingly fraught in recent years. A surge in demand and the supply chain crunch has led carriers to impose restrictive capacity limits and cut-off dates, dramatically raise rates, and even cancel service — and there’s been little brands can do to push back.

All of this has translated to lost revenue and a reckoning about how brands can continue delivering exceptional customer experiences. Read on to learn about the real cost of the shipping carrier problem and how a distributed fulfillment strategy can relieve brands’ reliance on the national shipping carriers and derisk their supply chain overall.

With the dramatic rise of e-commerce, carriers pump the breaks on residential deliveries

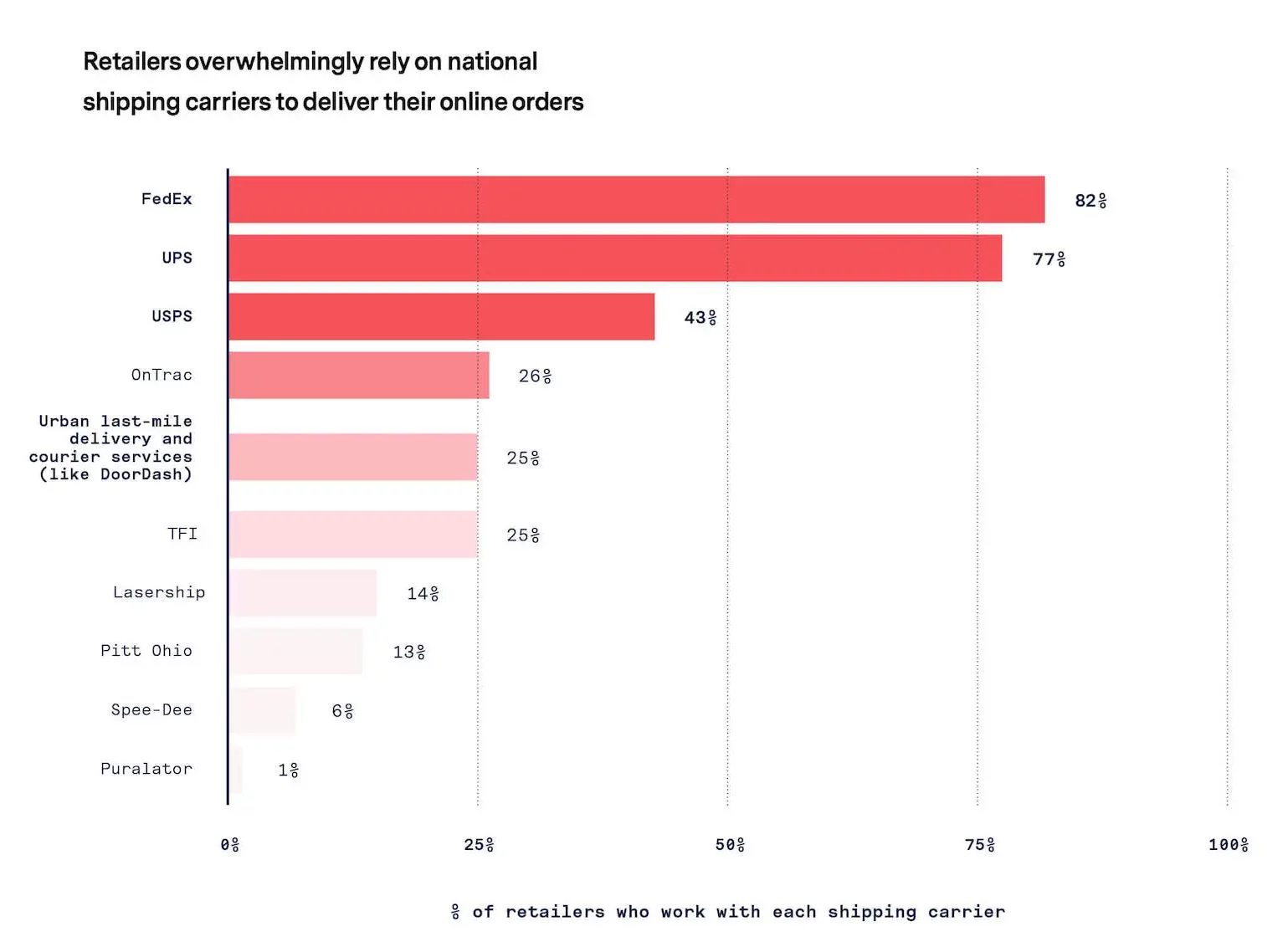

Brands’ reliance on the national shipping carriers can’t be overstated. Eighty-two percent of the retailers we surveyed work with FedEx, 77% work with UPS, and 43% work with the USPS, and Bloomberg reports that these three major carriers control about 95% of last-mile deliveries. On the flip side, a mere 26% of brands we surveyed rely on urban last-mile courier services, like Doordash.

The retailers-carrier relationship has long lacked balance, but the Covid-19 pandemic and accompanying surge in e-commerce has exacerbated the issue. The retailers and brands we surveyed reported that their e-commerce order volume grew by an average of 30% last year, and they’ve been scrambling to keep up.

Shipping carriers have also been overwhelmed, particularly given that residential deliveries — which are barely profitable for carriers (if at all) — make up the vast majority of this increase in orders. Not only are residential deliveries inefficient, one-package stops for carriers, they’re also riddled with inaccuracies and often located far apart from one another. For carriers, these kinds of deliveries are a huge headache without much upside.

In the face of this unanticipated volume, shipping carriers’ on-time performance has taken a big hit, with an estimated 3 million packages a day being delivered late even prior to the peak holiday season. These late deliveries are a costly burden for carriers, who often owe their retail partners money-back guarantees that items will be delivered on time.

Brands grapple with restrictive capacity limits and skyrocketing residential delivery rates

With money being lost, on-time performance suffering, and no sign of demand waning anytime soon, shipping carriers have taken some pretty dramatic steps to protect their bottom line. They’ve been ruthlessly culling their accounts, completely cutting off service to thousands of customers that they deem burdensome and unprofitable. In June, FedEx freight abruptly announced that it was cutting off service to 1,400 customers (including big brands like Lowes and Costco), and though the backlash from this announcement led them to reinstate service for some, many were left hanging.

At least from a metrics perspective, this culling paid off: 97.4% of FedEx deliveries, 99% of UPS deliveries, and 98.6% of USPS deliveries were delivered on-time during the all-important window between Thanksgiving and Christmas. Undoubtedly, those numbers would have looked a lot different if the carriers hadn’t dropped a massive amount of residential deliveries.

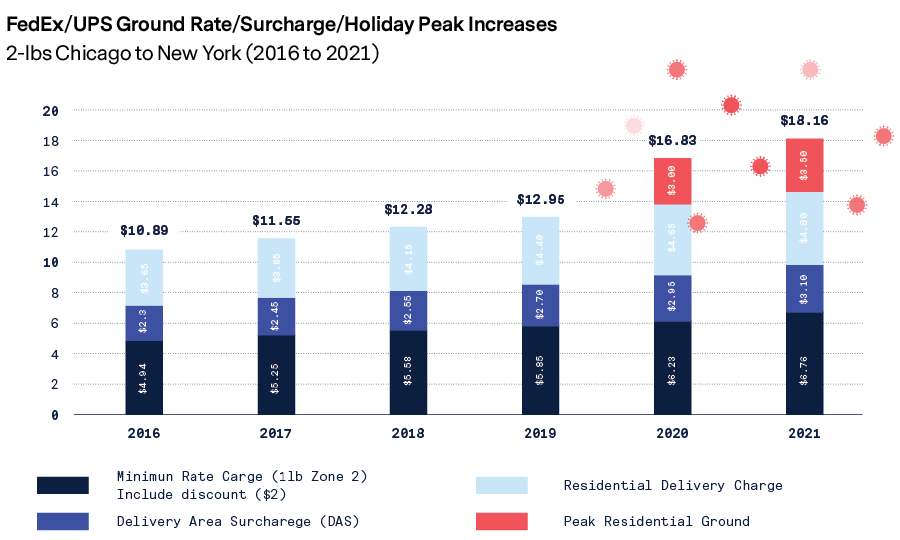

But even for the brands whose residential deliveries weren’t dropped, things weren’t smooth sailing. According to our proprietary research in partnership with Last Mile Consultants, carriers have been aggressively raising rates, with the price of residential deliveries skyrocketing 71% in just five years. And since customers are increasingly used to free shipping, brands are loathe to pass any of these costs on to them — which means brands are being forced to take a financial hit that can be catastrophic to their bottom line.

Retailers’ 2022 New Year’s Resolution: Solving the Fulfillment Problem

Although retailers have a lot of headaches to manage during these unpredictable items, fulfillment capacity single-handedly eclipses all the others. In our survey, retailers cited increasing fulfillment volume capacity as their top priority in the new year, and the CFO of Amazon said that the company’s focus in the coming year is “squarely on adding capacity to meet the current high customer demand.”

McKinsey estimates that online sales penetration has largely stabilized at about 30% above pre-pandemic levels, and we believe that the leveling off can be wholly attributed to an inability to fulfill orders. While some attribute this to people returning to their pre-Covid lifestyles, we think a much likelier reason is that retailers can’t keep up with this “shadow demand.” They’ve reached their fulfillment chokepoint, and it’s leaving money on the table.

We estimate that there’s a massive opportunity cost here. According to our calculations, online sales penetration would already be as high as 40% if retailers had the fulfillment capacity they needed to meet demand.

What’s more, in another effort to boost their on-time performance, carriers imposed restrictive capacity limits and cut-off dates during the holiday season. For brands who depend on this time of year to bring in the bulk of their revenue, this is a major blow.

That’s why brands cite carrier-imposed capacity limits as a top threat to their e-commerce business and reducing shipping costs as a top factor for success

Carriers have brands over a barrel. As their overstressed infrastructure began to crumble, carriers moved into preservation mode — and brands have paid the price (literally). Given this, it’s not surprising that the retailers we surveyed ranked shipping carrier capacity limits as a top threat to their entire business.

The soaring costs and reduced reliability of national shipping carriers have created an untenable situation for e-commerce brands, and they know something needs to change. In fact, the businesses we surveyed cited reducing shipping costs is a top factor for success in the coming year, above even reducing out-of-stock inventory or reliance on manual labor. To do this, they’ll first need to find a way to shift the current power imbalance back in their favor — something that will require a fundamentally different approach to order fulfillment.

To relieve their reliance on shipping carriers, it’s time for brands to take a new (and distributed) approach to fulfillment

Here’s the thing: this problem isn’t just caused by the decisions shipping carriers have made in a vacuum recent years; it’s a systemic problem that’s part and parcel of a centralized fulfillment strategy. When e-commerce volume was low and customer expectations around shipping time were slow, centralized fulfillment was a great fulfillment solution that leveraged the economies of scale.

But now that brands are experiencing an unprecedented influx of orders, and customers want their products within two days, maximum, that model can’t work on its own anymore. Centralized fulfillment networks have been stretched to the limit, and it’s clear that they need an assist from somewhere. Without one, the center will not hold.

For retailers to shift the power dynamic and get shipping service that actually lets them reach their true profit potential, they need to rely less on national carriers, instead taking a distributed micro-fulfillment approach. By spreading their inventory over a large network, they’ll have the option of working with urban last-mile carriers like DoorDash or Uber instead of the Big Three, as well as more leverage and flexibility when they do work with national carriers. A distributed network also drastically shortens shipping distances, which lets retailers circumvent cut-off dates and reduce overall shipping costs.

E-commerce would not be possible without national shipping carriers, but their iron grip on fulfillment has left retailers up against a wall. By pivoting to a diversified, distributed fulfillment approach, ecommerce brands can mitigate risk, increase profitability, and restore a healthier relationship with national shipping carriers.