Have you ever tried typing relentless.com into your search browser? The result is just one reason why the media is obsessed with positioning Amazon as the ultimate existential threat to retail, mercilessly undercutting the competition by selling merchandise at a loss and bankrolling their ambitions for world domination with profits from AWS.

While it’s true that Amazon is transforming the retail landscape at a stunning breadth and pace, Jeff Bezos’ latest schemes are not what’s keeping brands and retailers up at night. In fact, among 200 businesses we surveyed, Amazon is actually the lowest on their list of concerns — less than 18% of retailers cited it as a threat.

So what is plaguing retailers? In our newest report, we explore three unique challenges that retailers are currently confronting — fulfillment capacity, shipping carriers, and consumer expectations — and how businesses can best overcome them to stay competitive in this rapidly evolving landscape.

The X factor of the current state of retail is, of course, Covid-19

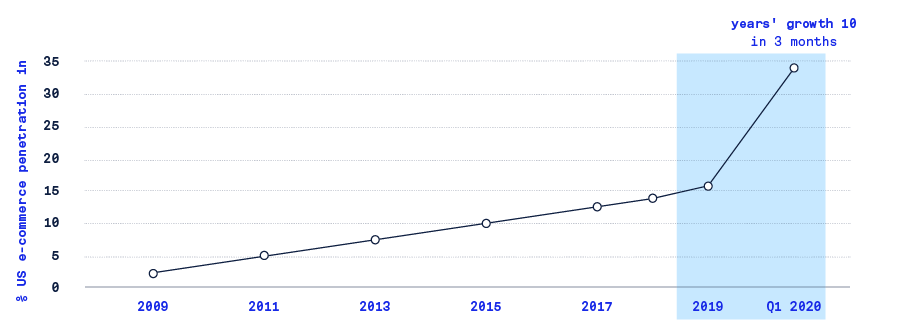

When lockdowns and shelter-in-place orders were instituted practically overnight in the spring of 2020, online sales penetration in the US saw roughly 10 years of growth within 90 days time. Since then, American consumers have largely maintained their online shopping habits, with e-commerce sales penetration holding steady at 30% above pre-pandemic levels. This sudden shift in consumer behavior has pushed supply chains to the breaking point and left retailers scrambling to adapt.

Challenge #1: Brands and retailers lack the necessary fulfillment capacity

99% of brands and retailers we surveyed report that they have lost sales due to lack of sufficient capacity, a problem that is largely caused by real estate and labor woes. Traditional fulfillment methods are an intensive use of real estate, and JLL projects that retailers will need an additional one billion square feet of warehouse space for e-commerce by 2025. As a result, industrial rent rates are spiking.

In addition to lacking the space to fulfill online orders, businesses also lack the manpower. While the “great resignation” has impacted every sector, the warehouse and transportation industry has been particularly hard hit, with a record 490K job openings in July.

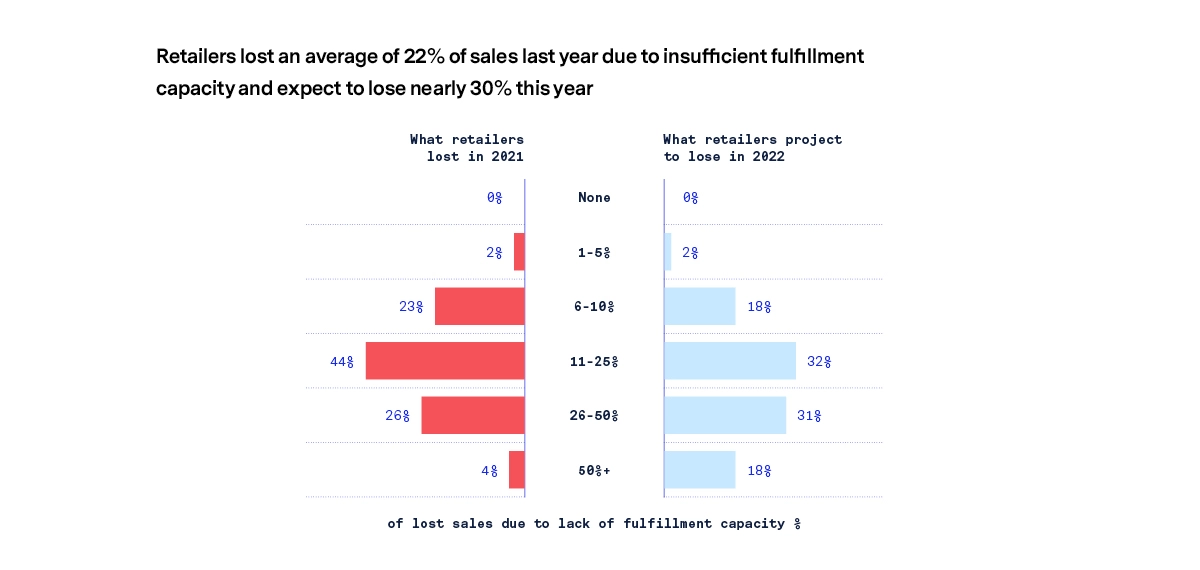

The inability to meet consumer demand means lost sales for brands and retailers. The businesses we surveyed lost an average of 22% of sales last year due to insufficient fulfillment capacity, and expect the problem to be even worse this year — on average, they expect to lose nearly 30% this year. Nearly 20% of retailers expect to lose more than 50% of sales (!).

The main driver of these losses? Among the brands and retailers we surveyed, due to insufficient fulfillment capacity…

- 54% are not advertising inventory they already have in stock

- 45% aren’t running promotions

- 50% have a backlog of orders that are being shipped late

That’s why the issue of fulfillment capacity single-handedly eclipses all other worries for retailers. We believe that if retailers had the fulfillment capacity they needed to earn the 22% of sales they estimate they lost last year, the online share of retail sales would be at 40% instead of the current 35%.

Our take:

Brands and retailers need to solve the fulfillment capacity crisis today while also building a fulfillment infrastructure that’s future-proof. Businesses don’t have time for slow initiatives like the typical three-year capital project of sourcing land and installing automation; they need to go live ASAP in the markets that are the most critical for them.

At the same time, investing in automation is a key long-term strategy to reducing retailers’ reliance on manual labor, an enormous fulfillment constraint that shows no sign of improving.

Challenge #2: The rise of e-commerce has put shipping carriers in a position of power

Even once retailers manage to overcome fulfillment capacity constraints, they face significant challenges in the next link of the supply chain: shipping orders to consumers’ doorsteps. UPS, FedEx, and USPS are said to control about 95% of last-mile deliveries, and the rise of e-commerce has put these shipping carriers in a position of power vis-a-vis retailers.

The retailers we surveyed reported their e-commerce order volume grew by an average of 30% last year, and the vast majority of these shipments have been residential deliveries, which for shipping carriers, are inefficient, barely profitable (if profitable at all), and besieged with headaches such as porch piracy. As a result of this unanticipated volume, shipping carriers have struggled to maintain their on-time performance, delivering a whopping 3 million packages a day late even prior to the 2021 peak season.

To protect their service levels, shipping carriers have found recourse in two major ways. First, they have severed ties with thousands of retailers whose residential delivery business has been burdensome and unprofitable. Second, they have aggressively raised their residential delivery rates with punitive surcharges for high-volume brands and retailers.

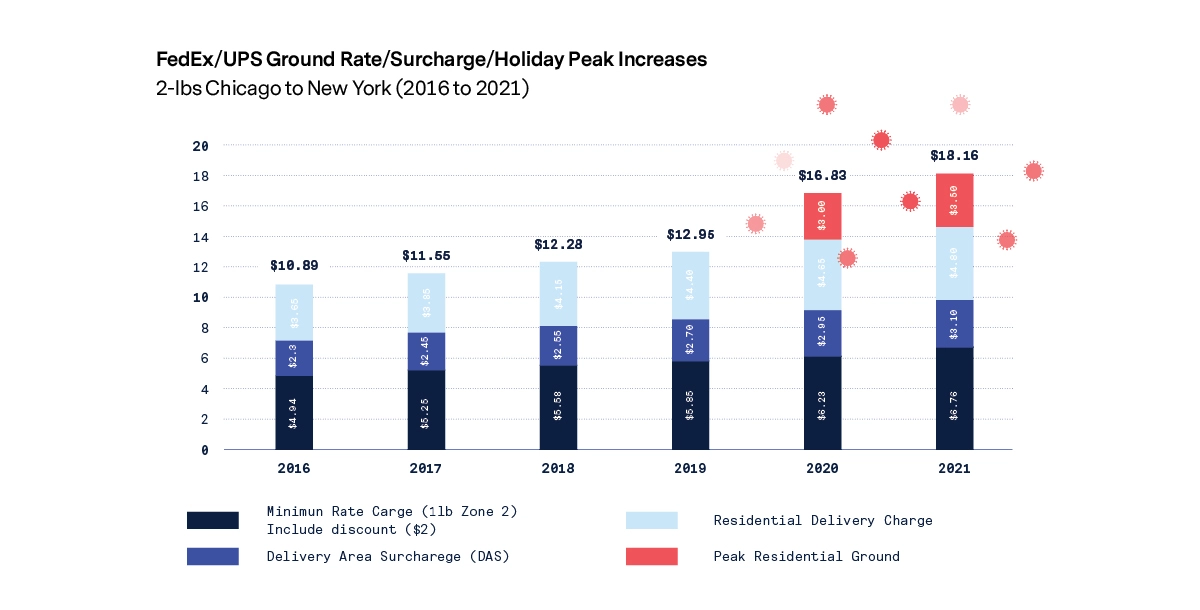

We estimate that shipping a 2-pound package via ground from Chicago to NYC skyrocketed from a little more than $10 in 2016 to more than $18 in 2021. That’s an increase of 71% in just five years, inviting the question: with free shipping now a given for most consumers, how long can merchants continue to eat these costs?

And the problem is worst of all during the lucrative holiday season (See: The true cost of shipping carrier-imposed constraints during the holidays.) It’s understandable, then, that retailers cite shipping carrier capacity limits as a top threat to their entire e-commerce business and state that reducing shipping costs is a top factor for success this year.

Our take:

Retailers and brands can best alleviate their overwhelming reliance on shipping carriers by augmenting their existing fulfillment operations with a distributed fulfillment strategy in targeted markets. A distributed strategy gives retailers more flexibility when negotiating capacity limits with shipping carriers, enables them to work last-mile courier services in addition to shipping carriers, and overcome painful cut-off dates by drastically shortening shipping distances.

Challenge #3: Retailers and consumers fail to see eye-to-eye about speed of delivery

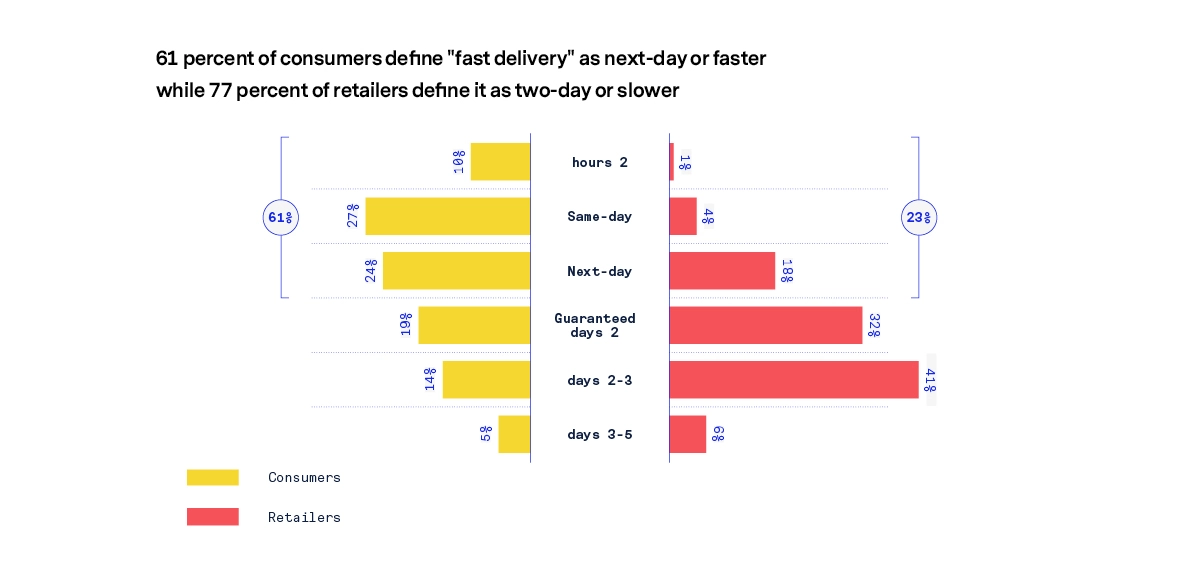

Not only are consumers shopping online more than ever; they expect their orders at their doorsteps faster than ever. Yet retailers and consumers fail to see eye-to-eye about what defines “fast.” According to 61% of consumers we surveyed, “fast” delivery is next-day or faster, while only 23% of retailers define it as such.

The discrepancy continues: 92% of consumers want retailers to provide free two-day shipping, with nearly 25% of them considering it a make-or-break factor when purchasing. Yet 40% of retailers don’t currently offer two-day shipping at all and among them, nearly half have no plan in place to offer it. In stark contrast to consumer expectations, 68% of retailers don’t believe that free two-day shipping is a requirement to stay competitive.

The pace of consumer expectations for fast delivery is already quickening, with same-day delivery right around the corner as the new consumer standard. 81% of consumers we surveyed said they’re more likely to purchase an item online if they can get it delivered the same day, and even 67% of consumers are even willing to pay for same-day delivery (which should be heartening news to brands and retailers everywhere who are already stretched thin.)

Yet 75% of retailers don’t offer paid same-day delivery, and only 36% of them think it’s a requirement to stay competitive today. It’s one thing to not offer a service because it’s operationally and financially difficult to do so; but it’s a mistake to hold the false perception that the service is unimportant. The same-day delivery market is poised to grow by $9.82 billion over the next 4 years.

Retailers are aware that fast delivery will be a requirement in the future; the majority of the retailers we surveyed believe that next-day and same-day delivery will be an absolute requirement to stay competitive within two years. But there’s a huge gap between what consumers currently expect, what retailers themselves know is coming, and the plans they have in place.

Our take:

Without a cost-effective and efficient local fulfillment solution, even next-day shipping isn’t sustainable for businesses. In order to meet rapidly evolving consumer expectations, retailers and brands should distribute inventory in locations that are closer to end-consumers, which dramatically reduces delivery times and lowers delivery costs. A distributed fulfillment solution that leverages automation makes a speedy proposition profitable and sustainable to boot.

It’s time to take a new approach to supply chains and e-commerce fulfillment

Ultimately these challenges are symptoms of a much larger, more systemic problem: centralized fulfillment, which remains a stalwart industry paradigm, is no longer sufficient on its own…

- Retailers and brands can’t build enormous centralized fulfillment centers fast enough to ramp up fulfillment capacity to where it needs to be

- Centralized fulfillment leaves businesses vulnerable to the whims and caprices of the nation’s very limited number of shipping carriers

- Centralized fulfillment from remote locations can’t support the fast deliveries that consumers now expect

We believe that retailers and brands would be best served by augmenting their existing fulfillment operations with automated micro-fulfillment in the right markets. This strategy — fulfilling e-commerce orders from a distributed network of local sites — is a long-term solution that enables retailers to future-proof their businesses for this brave new post-pandemic reality.